Biden's student loan forgiveness impact on Native students

'More help is needed.'

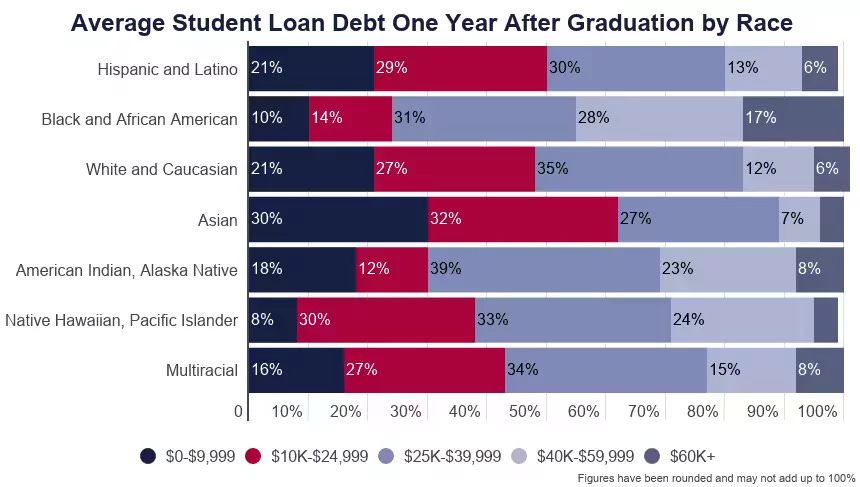

WASHINGTON — President Joe Biden’s plan to forgive $10k in student loan debt for people making less than $125k per year and $20k for Pell Grant borrowers is being celebrated by a number of Native education advocates.

At the same time, circumstances unique to Natives should have compelled the Biden administration to do…

Keep reading with a 7-day free trial

Subscribe to Indigenous Wire to keep reading this post and get 7 days of free access to the full post archives.